I’ve been thinking a lot recently about some of the key criteria that I use to identify future winning stocks. As I’ve now recorded hundreds of YouTube videos on my channel breaking down potential stock ideas, you start to see a pattern of the kinds of ideas that resonate with me.

High Returns on Capital are Important

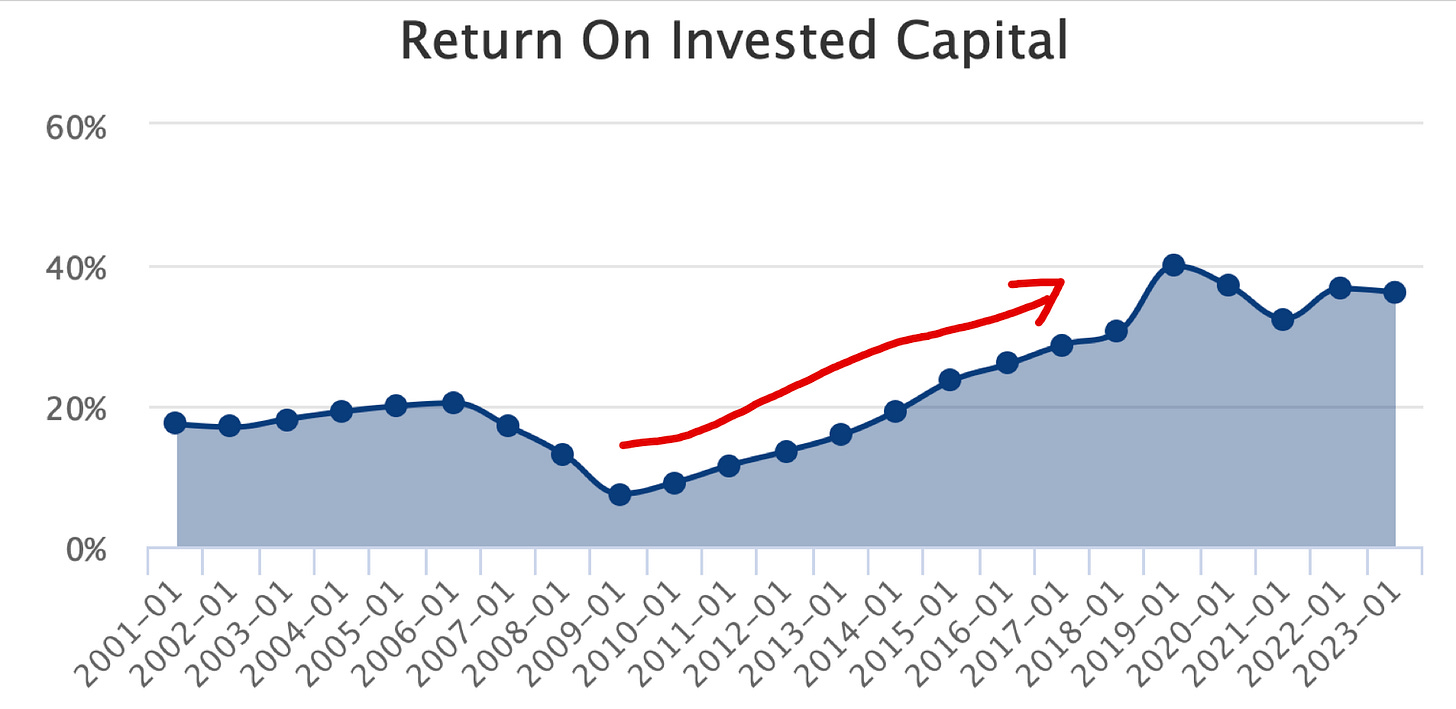

Home Depot - Ticker: HD 0.00%↑ is a good example of a compounder that I recently highlighted. They provide a textbook example of how high-returns on capital can translate to shareholder results over long periods of time.

Typically, I want to see a ROIC of at least 10% and a ROE of at least 15%. With a goal of compounding my personal wealth at 10%+ per year, I want to make sure that I only own companies that earn AT LEAST as much on their own capital. This is a simple hurdle that I believe makes sense.

If you want to earn 15%/year, then it makes sense to limit your holdings to only those stocks earning 15%+ ROIC.

Home Depot meets this threshold and well exceeds it with an impressive 30%+ returns.

Stable or Increasing ROIC is a good Metric

Not only do you want to see a high absolute return on invested capital number, you also want to see steadily improving OR stable returns on invested capital. In this case, HD 0.00%↑ has both. Stable here doesn’t necessarily mean flat. It simply means a very small change from year to year. Critically, you’re looking for a lack of cyclicality. You don’t see up and down cycles like you might with an oil company. This is a good marker of a high quality business.

The up and to the right nature of an increasing ROIC, suggests that the *incremental returns* (all that really matters) are actually higher than the current results. This implies strong unit economics, potentially operating leverage, and the ability for the company to reinvest earnings over time.

Compounders Require Growth

Home Depot sports growth of 7-8% on the revenue line and an astronomical 18% on the EPS line. For my purposes in this article, my focus is on revenue. Ideally, you’d have double digit revenue growth, but I don’t think that’s necessary to achieve double digit returns.

As you can see, Home Depot was able to turn 7% revenue growth into double digit EPS growth. That’s quite common. They could do so because of operating leverage that allowed them to earn more in bottom line profits for each incremental revenue dollar. As I covered in the video above, there are many reasons they’ve pulled this off including expense control, stock buybacks, and lower taxes.

My focus though is that you still need to have a high single digit growth rate. 7-8% is really the lowest I’d consider for what I want in a compounder that I own. Although operating leverage can push earnings faster, it isn’t a super power. Going from 8% revenue growth to 10% EPS is a lot easier than from 5% revenue growth to 10% EPS growth. 6% revenue growth and below is usually avoided on my part.

Hormel foods was another company I recently covered on my YouTube channel that has many characteristics of a compounder, but just barely missed my watchlist. (Video below)

As you can see, they have a very strong ROIC and ROE, but their growth rates are simply too low. There isn’t as much of a clear path to the double digit returns that I’d like to see. HRL 0.00%↑

The ability to reinvest is critical

Return on invested capital creates the baseline for what your past investment has been able to return to the business. However, returns for shareholders are driven by future investments. Without the ability to reinvest, shareholder returns are likely to be less than the past.

Hormel Foods - HRL 0.00%↑ simply lacks the same reinvestment opportunities as Home Depot, which shows in their overall growth rates. It also shows in the resulting underlying stock performance over long periods of time.

This is great!

I loved this Trey. Simple and extremely effective.