Solitron Devices makes a Transformative Acquisition

Thesis revisited as we enter a new stage of growth

On September 5th, 2023, Solitron Devices announced their closing of an acquisition of Micro Engineering. Micro Engineering is a small manufacturing company focused on the medical device industry. This acquisition adds an incremental ~$1 million USD in profits to Solitron’s bottom line, increases revenue by ~60%, and diversifies their business model across a whole second industry.

I expect this acquisition by Solitron to mark a new phase of growth in the company and I am hopeful that in the future it will be seen as a turning point whereby the market will begin to value $SODI shares less like a deep value stock and more like a growth company.

In today’s article, I’m going to break down some of the key financials and updates about the acquisition as well as forecast my thoughts about forward earnings and how I’m valuing Solitron today.

Solitron’s Acquisition Price of Micro Engineering is for a very attractive

Solitron’s purchase price for Micro Engineering is approximately $4.5-$5 million USD.

Up-front payments involved a $300k deposit + ~$2.7m in a closing cash payment for about a $3m total purchase price. There are some adjustments for working capital and Solitron appears to have paid transaction expenses for the seller as well.

In addition to the purchase price of $3m, Solitron will be paying 7.5% of gross revenues earned by Micro Engineering for the next 3 years (36 months across 4 calendar years). If we assume that revenues over the next 3 years are about flat against 2022 revenues, then we would expect additional purchase consideration of about $1.5m USD. If the company continues to grow, which Solitron shareholders should want, then the purchase cost may be additional $2m or so of expense.

Consequently, I’m mentally calculating that this acquisition includes total consideration of about $4.5-$5m USD.

Micro Engineering Financials

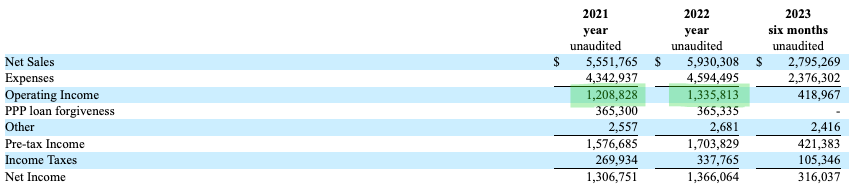

Solitron provided unaudited results for the last two years at Micro Engineering and they show a business with operating income of $1.2m in 2021 and $1.33m in 2022. Revenues grew by 6.8% from 2021 to 2022 for an ending total of $5.9m in 2022.

I am focused primarily on the operating income line because the bottom line results are distorted heavily by the presence of PPP loan forgiveness in both 2021 and 2022. We basically have to ignore everything below the Operating Income line otherwise we are likely to overestimate the value of this acquisition.

Even when we remove PPP loan forgiveness from the occasion and estimate income taxes ~21% we still end up with bottom line net income of ~$1m. If we assume that Micro Engineering continues to grow or at least not decline in revenue, then Solitron just purchased the company for about 5x Earnings or Less. That is an incredible purchase price.