Entercom Communications Intrinsic Value Analysis (ETM) - FREE SAMPLE

NOTE: This intrinsic value analysis is being provided as a free sample to free subscribers of the type of analysis available exclusively for the paid membership.

This intrinsic value calculation uses data from Entercom’s 2018 10k annual report and Q4 2018 earnings call transcript. I completed the calculation on April 26th, 2019.

Entercom Intrinsic Value Analysis – Methodology

Entercom Communications is a holding company for radio stations based in the United States. Entercom’s primary form of revenue comes in the form of selling advertising slots during its radio broadcasts.

I will calculate Entercom Communication’s Intrinsic Value by first outlining the assumptions that I used to calculate intrinsic value.

Second, I’ll present my intrinsic value calculation and result.

Third, I’ll provide background information on how I came up with my assumptions.

Entercom Communications Intrinsic Value Calculation

First, we’ll discuss my assumptions used in the calculation.

Conservative Assumptions used for Entercom’s Discounted Cash Flow Calculation

$1.38 in free cash flow for 2019

2.5% revenue growth for 2019-2020

0.5% long-term revenue growth for 2021+

No net cost synergies achieved in 2020 or beyond. (This should be quite conservative)

10% discount rate

Entercom Communications Intrinsic Value:

Second, I used the above assumptions to calculate Entercom’s intrinsic value using a multi-year discounted cash flow calculation. The spreadsheet below shows my results. Patrons can download a copy of this spreadsheet from the Patreon post.

The result: Entercom’s Intrinsic Value = $13.67 per share

Background on Assumptions used in Intrinsic Value Calculation

Entercom Communications provides a lot of detail in their investor presentations and regulatory disclosures that help us to calculate intrinsic value.

Entercom’s method for calculating Free-Cash-Flow

Entercom calculates free cash flow internally using the following equation:

Free Cash Flow = EBITDA – Cash Interest – Cash Taxes – Capex

I believe this is a reasonable formula for determining the owner’s earnings available for dividends, share buybacks, and debt reduction, so I will go ahead and use it.

Original Free Cash Flow Forecast from 2017 Merger

In 2017, Entercom merged with CBS Radio forecast that they would have cash flow of $1.24 per share without taking into account any merger synergies. They reached this result using the following numbers:

EBITDA = $368 million

Cash Interest = $96 million

Cash Taxes = $55 million

Capital Expenditures = $39 million

Assumption: Maintenance capex = $32 million (2017 – 2020) or about 2% of net revenues

Let’s apply these numbers back into our formula:

Free Cash Flow = $368 – $96 – $55 – $39 = $177 million

Divide that by the expected 142.3 million shares outstanding and the result is $1.24 FCF/share.

Entercom’s (ETM) actual 2018 free cash flow results

In 2018, Entercom experienced challenges that caused them to underperform expectations. You can review the actual results below:

Adj. EBITDA = $310 million

Cash Interest = $96.8 million

Cash Taxes = $54.2 million

Capital Expenditures = $41.7 million

EBITDA came in much lower than expected even though the other projections were fairly accurate. Lower revenues than expected was the primary driver for the massive drop in EBITDA. As a result, 2018 free cash flow was also much lower.

Free Cash Flow = $310 – $96.8 – $54.2 – $41.7 = $151 million

Divide that by outstanding shares of 138.8 million and the result is $1.09 per share.

Conservatively Forecasting 2019 Cash Flow

The next step in the intrinsic value calculation process is to use this background information to forecast free cash flow per share for 2019.

A key reason for the merger between Entercom and CBS Radio was the potential for Entercom’s experienced management to turnaround the performance of the CBS radio stations. In the process, Entercom could create net cost synergies and reduce the operating cost of the new overall business.

Management has repeatedly guided for $45 million in net cost synergies to be realized in 2019. This savings is the amount of cost reduction expected after investing in other areas of the business. Therefore, savings will be greater than $45 million, but only $45 million will reach the income statement.

As Entercom’s management has been very transparent throughout this merger process, and I trust their projections, we’ll take the $45 million in savings at face value. Without taking credit for any critical revenue growth in 2019, we can determine a conservative free cash flow number.

$151.9 million (2018) + $45 million (2019) = $196.9 million free cash flow

Current shares outstanding = 141.7 million, resulting in $1.38 per share in free cash flow for 2019.

Estimate Uncertainty

My free cash flow estimate likely underestimates the free cash flow for 2019. The company is executing on additional opportunities to reduce debt, interesting, etc…which may cause this number to be higher than expected. I would also expect free cash flow to grow again in 2020, but it is difficult to project at this time due to the uncertainty of capital spending and changes in cash usage by management.

Estimating Entercom’s Future Revenue Growth and Net Cost Synergies

Besides the discount rate, the remainder of my assumptions around intrinsic value is about revenue growth and changes in costs.

First and foremost is revenue growth. I project revenue growth in two phases, short-term and long-term. The short-term growth is only for the next two years. Here, I am using 2.5% as a revenue growth rate. This number originates from the original 2017 merger projection of growth from 2017-2020.

In that merger presentation, Entercom’s management forecast annualized revenue growth of 2-3% over the 3 year time frame. Currently, Entercom is growing revenues at a rate of 3% in 2019, so I am comfortable with using 2.5% as an estimate.

Long-term Revenue Growth Rates for the Radio Industry

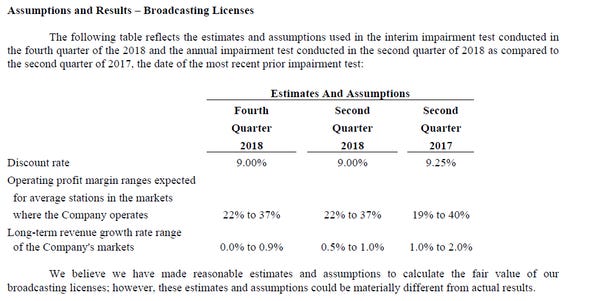

For long-term growth assumptions, I also defer to management’s projections for the radio industry. They disclosed these assumptions in the 2018 10K, as seen below.

This snippet is taken from the Entercom Communications 2018 10K regulatory disclosure. My key takeaway is the long-term revenue growth rate range of 0.0-0.9%.

As you can see, my assumption of 0.5% long-term revenue growth is taken directly from the management’s projections.

Future Net Cost Synergies: Assumed to be zero

Finally, I conclude my assumption development by assuming that future net cost synergies will equal zero. This is likely conservative because I would expect additional cost savings in 2020 based upon management’s guidance so far. However, without explicit figures, and an understanding of management’s projections, I will defer to assuming no cost savings.

It is always better to err on the safe side when developing your assumptions.

That wraps up my intrinsic value analysis of Entercom Communications (ETM). My result was an intrinsic value of $13.67 per share.

As always, do your own due diligence and make your own judgment about what reasonable assumptions might be for Entercom’s business.

Note: (03/30/2022) This calculation was completed in 2019, so some of the data is currently outdated here in 2022. However, the method I used then is the same process I would use today for valuing $ETM, except with updated numbers. It is worth noting as well that $ETM has changed it’s stock ticker to $AUD and name to Audacy.

NOTE: This intrinsic value analysis is being provided as a free sample to free subscribers of the type of analysis available exclusively for the paid membership.

Investing Disclaimer

All investments involve risks and any investment can result in a complete loss of capital. ALWAYS do your own research prior to purchasing an investment. I am NOT a financial advisor. I am NOT a registered investment advisor and I do NOT provide investment advice. None of the rewards, research, or other benefits from being a member/patron of DIY Investing’s membership site should be construed as investment advice. I have NOT taken into account your personal financial situation in developing this content. I shall NOT be held liable for any errors or omissions in the content provided on this website. All content is provided for informational and educational purposes only. I, Trey Henninger, and DIYInvesting.org shall NOT be held liable for any investment decisions made from the use of the content provided via the DIYInvesting.org website. Read my full Terms of Service for additional information.