DIYInvesting Update / State of the Market

Market in Freefall / Inflation to the Moon

2022 has been a very difficult year for the average investor. What worked in 2021 and 2020 no longer works today. The growth / momentum / high-tech stocks have all fallen terribly. While the market is not yet in a bear market, you have individual securities down 50, 60, 70%+.

This hasn’t been isolated to tech as the market continues to price in higher interest rates in the future. Any company that is longer in duration (unprofitable or dependent on financing is being taken to the woodshed).

As you may know, I don’t incorporate macro views into my process. I’m 100% a bottom-up fundamental investor. However, I find macro developments interesting and worth considering for understanding the broader context of how we invest our money. Certainly as inflation rises, the need to earn an adequate return also increases. Hurdle rates necessarily increase.

This phenomenon isn’t enacted overnight. Each marginal investor makes that adjustment at their own pace. What results is very similar to what we’re seeing in the market: Volatility. There is broad uncertainty about the future and no one KNOWS what it going to happen. Therefore, pricing fluctuates wildly until we have ‘priced in’ the collective thoughts of the investor community.

My continued belief is that regardless of the interest rate environment, investors who focus on buying cash producing, profitable, growing companies with a high return on equity, will be rewarded. That has been historically true and I expect it will continue to hold true today and in the future.

With that background, I read a very good article recently on how housing costs play into the inflation calculations for CPI. It’s worth a read.

The important takeaway: Housing’s adjustment within the CPI tends to show up with a one-year lag. The ~5% number we see today is really showing that 5% increase occurred 1 year ago. The ~15-20% increase in home prices over the last year, won’t really show up until May of 2023.

Not a forecast. Just an observation I found interesting.

Free Content you may have missed

Not all of my stock-specific content is in a written format. I’ve been steadily working my way through every company in the S&P 500 with a screen share review of each company’s financials. Since the beginning of May, I’ve published 10 videos on my YouTube channel. (Subscribe here: http://goo.gl/nHGXvj )

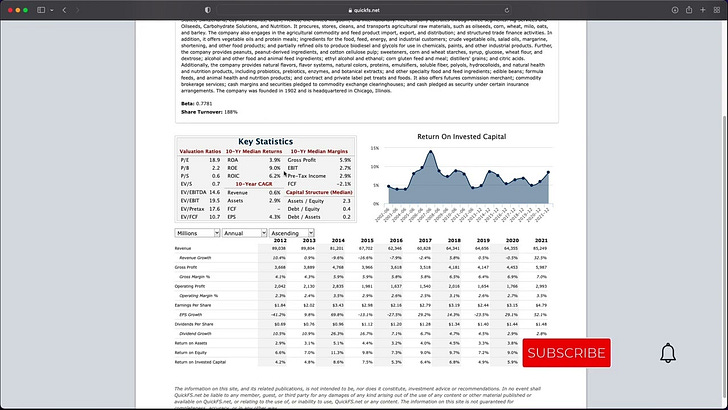

Archer-Daniels Midland (Ticker: $ADM)

Arista Networks (Ticker: $ANET) - This one was added to my watchlist

Arthur J. Gallagher (Ticker: $AJG)

Assurant (Ticker: AIZ)

AT&T (Ticker: T)

Atmos Energy ($ATO)

AutoDesk (Ticker: ADSK)

Automatic Data Processing (Ticker: ADP) - This one made it on my watchlist

AutoZone (Ticker: AZO) - This one made it on my watchlist

AvalonBay Communities (Ticker: AVB)

Thoughts on my S&P 500 Case Studies so far

As I continue to work through these companies in the S&P 500, I am continually convinced that Utility companies and REITs are not earning their cost of capital. Without cheap debt financing, the entire sectors should be avoided, and even with debt financing, returns are likely to underperform.

Part of my working through this exercise is to broaden my circle of competence. Another part is to make sure I understand other opportunities may be available in Large Caps at times in the future.

However, it is quite clear that the best opportunities continue to be in small, illiquid, microchip stocks. There are some amazingly high quality companies in the S&P500. Yet, you’ll be paying 20, 30, 50+ times earnings for those companies. If you buy microcap stocks, you can often find quality stocks for less than 10x earnings. That’s the microcap difference.

Paid Content you may have missed

Paid subscribers have received access to two exclusive updates so far in May.

The first covered a potential special situation which I thought was very interesting.

In my second research report, I discussed my favorite company. This is the top stock in my portfolio and also happens to be a very unique bank stock.

Thinking about the Future of my Portfolio

This year has certainly been difficult for the performance of my portfolio, but I continue to believe that future returns are going to be very much acceptable. With a combination of the decline in prices and my continued buying efforts, I currently hold a portfolio with a present earnings yield of ~16%.